Another day, another centrepiece policy from the Justin Trudeau era hurled into the trash can.

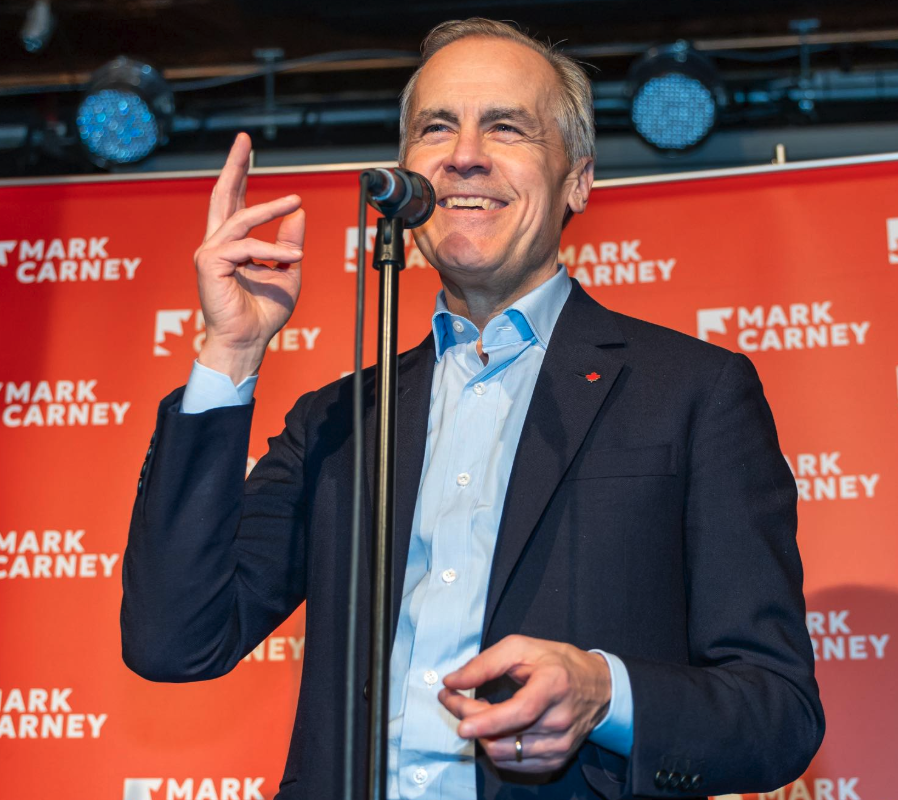

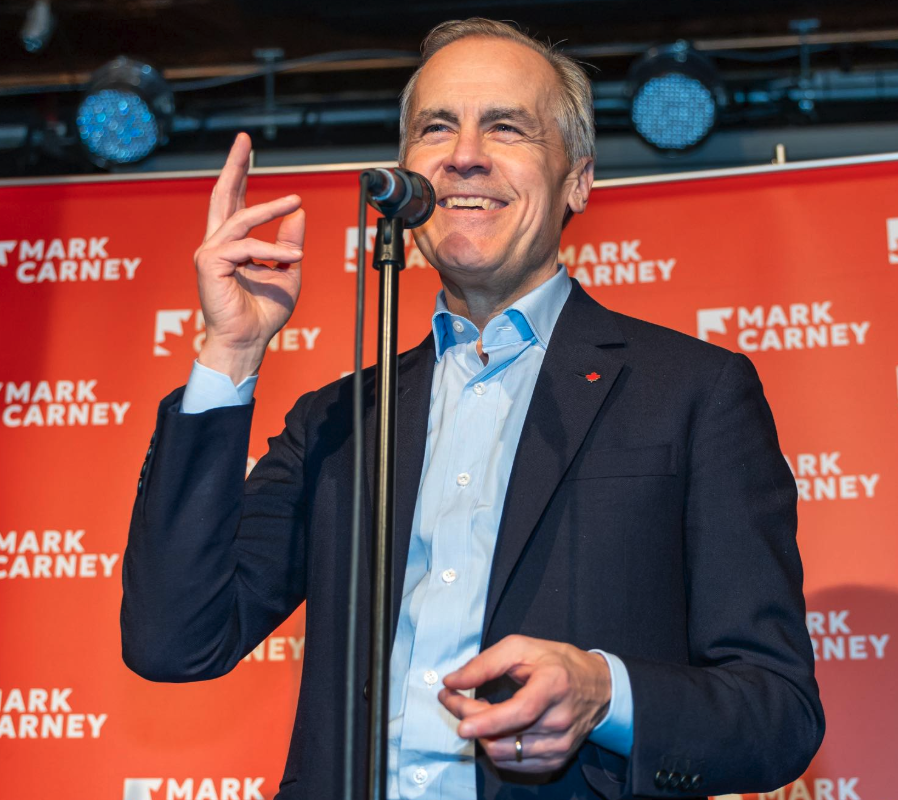

Prime Minister Mark Carney said the proposed hike in the capital gains inclusion rate – which the Liberal government had argued would raise more than $19 billion in tax over five years – will no longer go forward, having already been delayed.

It’s the second time in as many weeks that Carney has ditched a key Trudeau tax initiative, having last week pledged to abolish the consumer carbon price.

It’s also the second time in as many days that the prime minister has aligned his party with Pierre Poilievre’s Conservatives.

The Tories pledged to do away with the capital gains inclusion rate hike on Jan. 16, with Poilievre blaming Carney himself for supporting the “job-killing tax increase.”

Poilievre on Thursday accused the Liberals of plagiarizing his policies after Carney announced his intention to abolish the GST on new homes under $1 million for first-time buyers.

Many businesspeople, as well as doctors, had complained about the change to the capital gains system, warning it could disincentivize investment.

It would have meant that individuals and businesses reporting more than $250,000 of capital gains in a year would pay a higher proportion of tax on their gains.

“Canada is a country of builders,” Carney said. “Cancelling the hike in capital gains tax will catalyze investment across our communities and incentivize builders, innovators, and entrepreneurs to grow their businesses in Canada, creating more higher paying jobs.

“It’s time to build one Canadian economy – the strongest economy in the G7.”

The Prime Minister’s Office said the government still plans to increase the lifetime capital gains exemption limit to $1.25 million on the sale of small business shares as well as farming and fishing property.